Turn Chaos Into Capital

Stop chasing investors across email threads.

Structure your round like the pros do.

Know who's ready to wire—right now.

Issuer-direct; Deal Box is not a broker-dealer.

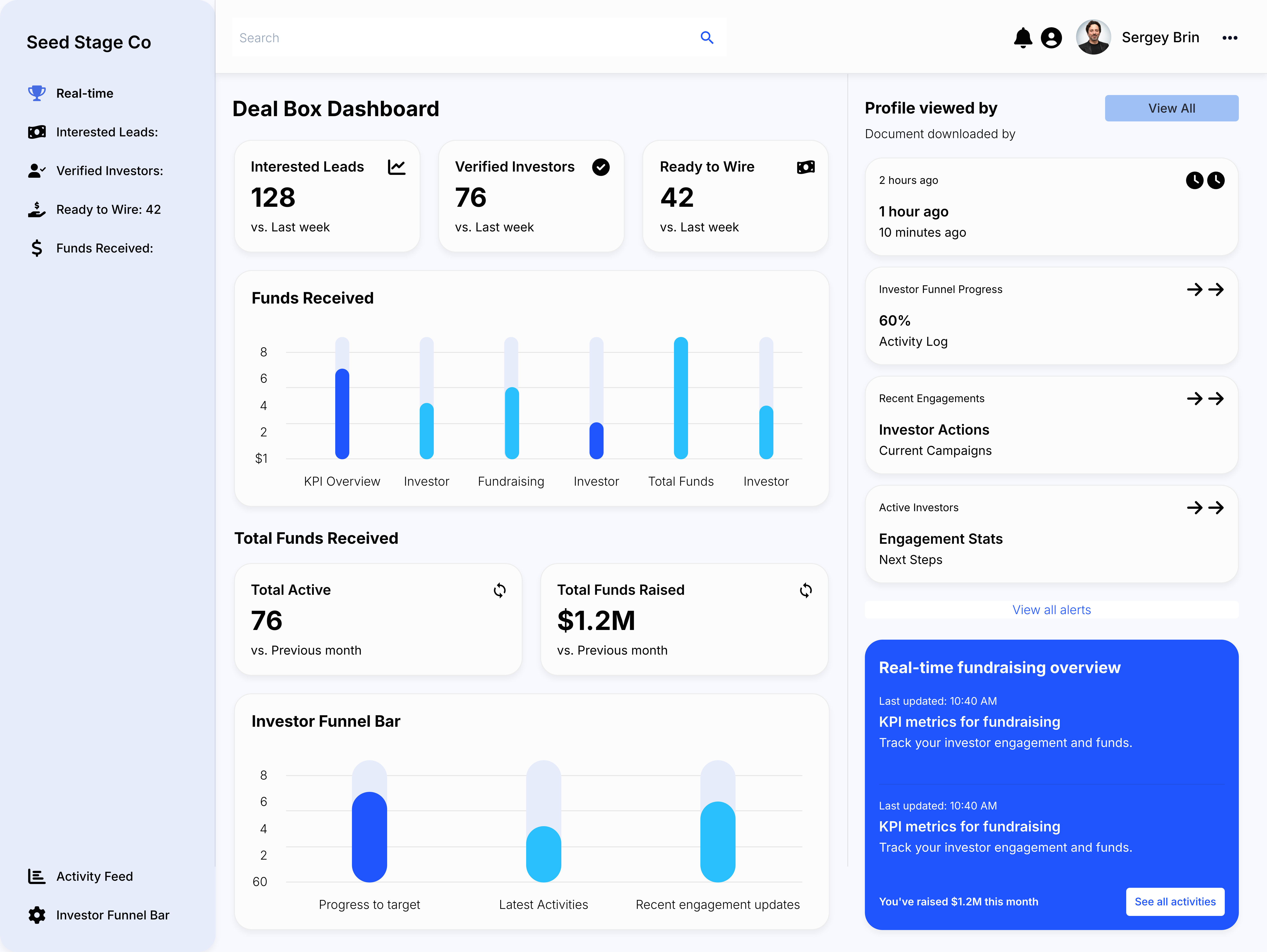

Watch Money Move

Trusted by Hundreds of Startup Founders and VC Funds

For Founders

Stop begging for updates. Launch in weeks.

For Investors

Verify once. Access vetted 506(c) deals. Skip the noise.

You've Built Something Worth Funding.

Others close in weeks. You're months deep chasing leads. It's not your business—it's infrastructure.

Before Deal Box

12 tools: shared drives, DocuSign, cap table spreadsheets, KYC vendors, ad-hoc dashboards.

3–6 months to get your round investor-ready.

No clear funnel from "interested" to "funded".

After Deal Box

One portal: docs, accreditation, status, and wiring in one link.

4–6 weeks to structure, package, and launch your raise.

Live analytics across the investor journey.

Hundreds of private offerings since 2006.

Deal Box has packaged and supported hundreds of Reg D, Reg A, and Reg S offerings—across software, funds, and tokenized structures.

Complete Infrastructure for Private Markets

From capital formation to tokenization to exchange listings—Deal Box provides the platform and advisory backbone.

Your entire raise, in one link.

Share one place for docs, accreditation, status, and wiring—whether you're running 506(b), 506(c), fund vehicles, or SPVs.

Start your raise the right way.

Get your structure, docs, and diligence done correctly from day one—so investors take you seriously and your round actually closes.

Add liquidity to any round.

Layer in tokenized equity, revenue notes, or yield instruments to create programmable, compliant liquidity pathways.

Launch your token with confidence.

Institutional tokenomics, TGE planning, and Tier-1/Tier-2 exchange readiness for Web3 teams preparing to list.

The Network

A secure access environment for verified participants—education, verification, and issuer-direct 506(c) offering access. No lead-brokering, no solicitation.

Latest Perspectives

Market insights and analysis from the Deal Box team. Fresh perspectives on private markets, tokenization, and capital formation.

Tokenization That Complements Your Raise

Not hype—real liquidity pathways, revenue instruments, and programmable compliance. Deal Box designs frameworks that connect traditional securities with digital assets.

Enable structured secondary sales tied to revenue milestones—founders take liquidity while retaining control.

Digital securities with automated transfer restrictions, accreditation checks, and compliance logic built-in.

Secondary market infrastructure and digital buyback mechanisms—no full exit events required.

Trusted by Visionary Founders

Real companies that chose Deal Box to power their capital formation.

"Any early-stage company raising money is going to want Investment Packaging. It will save them a lot of time and energy."

"My original deal wouldn't allow for investment. Deal Box helped us structure our equity in a way that made the business speak for itself."

"Deal Box communicated our value effectively to all investors and provided the strategy we needed to win. We closed our round thanks to them."

"Deal Box helped our team identify the right framework for our offering. Deal Box has truly helped our company achieve the seemingly impossible."

"Deal Box packaged RWAP's raise into one secure link — diligence materials, investor deck and brief, model, and portal — making investor engagement and onboarding seamless from start to subscription."

"Any early stage company looking to raise funds is going to want to use Deal Box. It will save them a lot of time and energy."

"Deal Box was the most important partner for completing our raise and understanding how to best position our company for the future."

"Deal Box's Investment Packaging brought structure and clarity to ONVI's raise — helping us communicate our value to investors with one organized, credible platform."

"Deal Box allowed us to concentrate on our product and profitability. Investment Packaging is a winning formula for raising money efficiently."

Ready to Get Started?

Schedule a demo to see how Deal Box can transform your capital formation process.